By declaring the trade war with China, the US President Donald Trump has achieved unequivocal dominance in the import of genetically modified soybeans into the European Union. In the last seven months of the year, US soybean imports increased by 112 percent and gained a 75 percent share of the US import market. America’s dominance would increase even more after the EU agrees to use soybeans from GMOs to produce biofuels as well.

More than 34 million tonnes of soybean meal is imported into Europe each year, not only from the US but also from Brazil and Argentina, whereby the current rise in US dominance is at the expense of these two South American countries. As a whole, the EU is dependent on imports of soy and soybean meal for food use. However, some countries, such as Poland, Austria, Italy, France and Germany, have the farming system set so that only organic and genetically unmodified soy can be used as a compound feed.

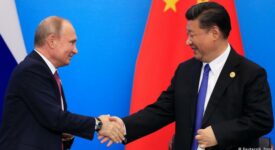

Earlier this week, the United States began negotiating with both the European Union and China. Trying to resolve disputes, China allowed imports of American rice and other five GMOs for the first time in history. However, it is questionable to what extent Beijing’s steps will make Trump to change his opinions. Last summer, the US president talked openly about how American security is threatened by cars imported from the European Union. While a meeting with European Commission chief Jean-Claude Juncker discouraged Donald Trump from actually implementing his sharp increase in tariffs, this meeting has resulted in the opening of the European market to American soybeans.

This happened at a time when Chinese imports of American soybeans were banned for the ever-increasing US tariffs. The rise of prices of Chinese products on the US market is already starting to show slowdown in Chinese production. “The Chinese government seems to underestimate the impact of the war with the US. Although it still has some fiscal measures in stock, our biggest concern is that the credit cycle in China is similar to that in Japan and Europe, “said Peter Garnry, Saxo Bank stock strategist.

In extreme cases, even cheap loans aren’t able to maintain strong economic growth, and China might face a recession first time since 1976. Since then, the local population has not been subjected to a sudden drop in living standards in the form of massive redundancies and subsequent non-repayment of loans. It is precisely fears of the threat of a possible recession that the Chinese side can push for an agreement during the current 90-day ceasefire.